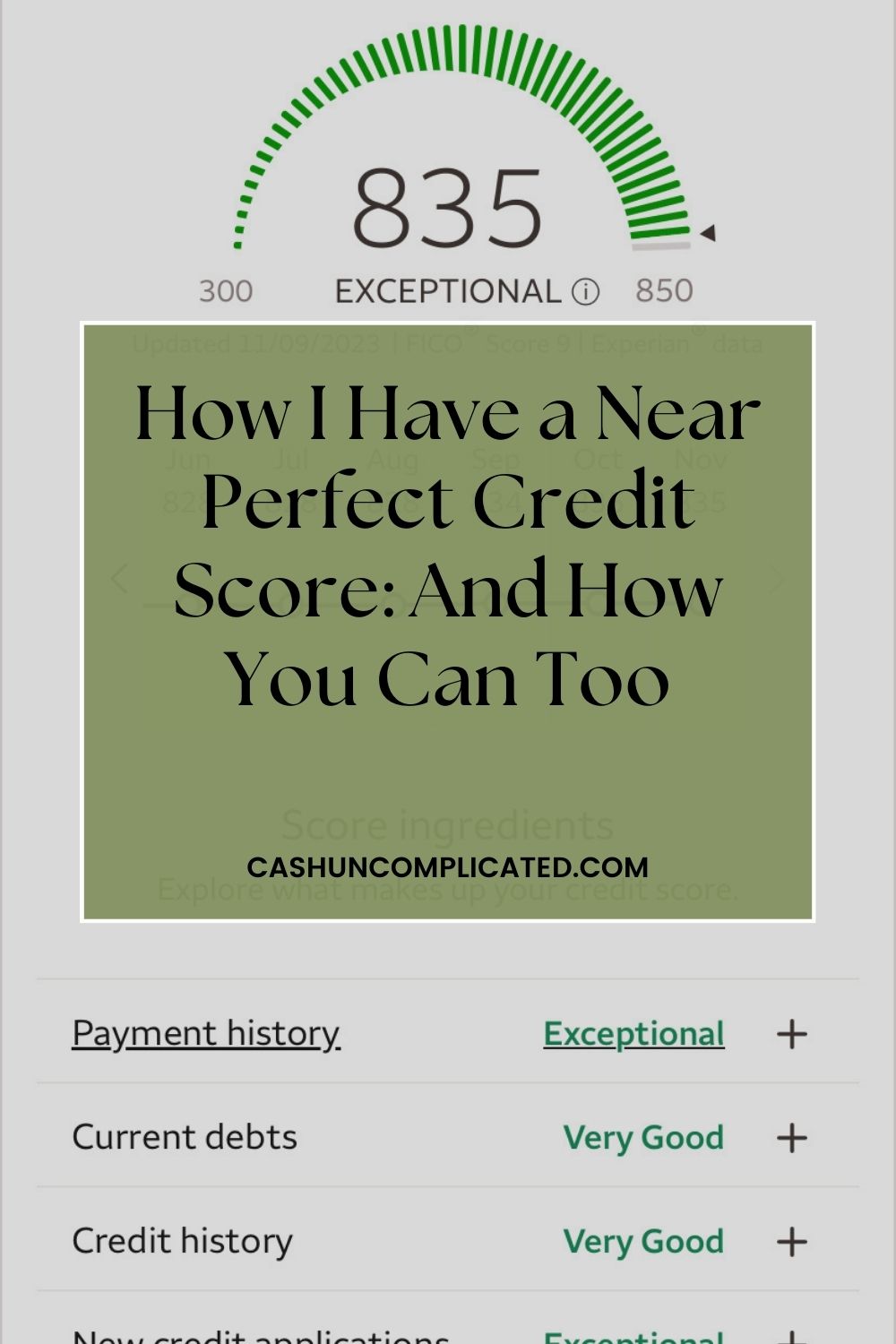

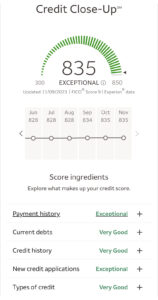

Most of my posts are about financial principles that have worked for hundreds of years, and will likely work for hundreds more. Today I’m focusing on one of the possible results of following these financial principles–a near perfect credit score.

My Background

It’s never been my goal to achieve a near perfect credit score. There are plenty of articles online about various hacks you can use to increase your credit score, I almost never pay attention to them. Not that they don’t have any value, I just don’t think they have much value to me personally.

I’m a believer in following certain personal finance principles–that if followed, will organically lead to a lot of positives. Positives such as a high net worth, no consumer debt, time and financial freedom. You can throw a high credit score into that mix as well.

What This Post Is Not About

This isn’t a post about hacks or shortcuts to get a near perfect credit score. I would never promise that someone with a sub-600 credit score can read a blog online and suddenly reach a high credit score, much less a near perfect one. So there are no shortcuts here.

Why Does a Credit Score Matter?

A high credit score isn’t the pinnacle of personal finance success but it does help make life easier.

- People with higher credit scores get more favorable rates on mortgages and loans

- Some jobs check credit scores

- Property managers/landlords check credit scores to gauge how likely a prospective tenant is to pay the rent in full, and on time

- Multiple other reasons

So you don’t “need” to have a high credit score, but it does help make things easier. And my philosophy has always been to make things easier, or create advantages for yourself, when you can.

How I Achieved a Near Perfect Credit Score

As I alluded to in the beginning of this post, I’ve never been one to give hacks to increase your credit score. I believe in the process of following timeless financial principles. I also believe that if they’re followed, a great credit score will naturally follow without any additional effort.

I’ll give the analogy of a basketball player trying to increase their free throw percentage. If they practice the correct shooting motion and focus on the fundamentals, their percentage is naturally going to go up. There are no hacks or shortcuts to it. It’s a matter of getting those things right and the numbers will follow.

The rest of this post will be about the principles I have followed (and continue to follow) to achieve a near perfect credit score.

Number 1: Eliminate All Consumer Debt

I think one of the foundational principles in personal finance is to eliminate all consumer debt. Or better yet, don’t have any in the first place (something I didn’t do).

This creates a rock solid base where you can save, invest, and get out of the paycheck to paycheck cycle. Of course it also means you’re not making payments on things you bought months and years ago. You’re staying ahead of the game.

Related:

Number 2: Keep an Emergency Account

The unknowns are going to come up in life. That’s why they are the unknowns, or emergencies. This is why it’s so important to keep an emergency fund.

We can try and predict all we want, but the fact remains that nobody can predict the future. The water heater can go out, medical issues come up, unexpected weather can destroy a roof. The list of the unknowns goes on and on.

Even with good insurance, an emergency fund is still one of the best methods I know about to protect against the unknown.

Related:

Number 3: Automate Savings and Investments

Number three on the list of how I have a near perfect credit score is that I automate my savings and investments. Automation is key because it takes the thought and decision making out of my monthly spending allocations.

I don’t have to think about how much I’m going to save or invest because I’ve already done that work up front. I know exactly how much is being allocated to savings and investments. And I have already done the work by setting up the money to be automatically dispersed to each account. This minimizes decision fatigue and puts my money on autopilot.

Automating in of itself won’t increase your credit score but it gives you the financial foundation you need to build up your credit score. In other words, if there is a situation where I need money to cover a cost, or even take a vacation, I have enough to do it without getting into credit card debt. Staying out of credit card debt maintains or increases your credit score.

Number 4: No Car Payments

You can’t default on a debt you don’t have. That’s one of my many reasons for not having car payments. Car payments also increase your debt-to-income ratio, which isn’t helpful in obtaining a higher score.

Again, this post is not meant as a bunch of hacks to achieve a higher credit score. It’s about creating solid financial habits that will naturally help you build a better credit score.

Avoiding car payments is not about trying to raise your credit score, it’s more about building financial habits.

Number 5: Maintain a Low Cost of Living

Maintaining a low cost of living is one of the low hanging fruits anyone can achieve regardless of income, education, social status, etc. It does however require intentionality and the ability to spot good opportunities.

Let me give you two different examples from my life where I was able to achieve a low cost of living. The first is when I was in my early twenties. Instead of getting my own place like others were doing at the time, I responded to an ad on Craigslist (that’s how we used to find housing) for a roommate.

I was one of four and that really helped keep costs down. So by willing to live with other people, it cut my costs well over 50 percent than if I had tried to get my own place.

The second example is my current house. My family and I live in a lower cost of living area than we can easily afford. Plus we househack an ADU that we added to the backyard. That allows us to own our own home and save and invest at the same time.

Without this combination of lower cost of living and house hacking, we would really struggle to invest the amount of money we want to every month. And while this doesn’t directly affect our credit score, it creates a solid base where we’re not paycheck to paycheck, which would put us in danger of one check away from having to take out unnecessary debt.

Number 6: Value-Based Spending

Consumer debt can really hurt a credit score, especially those who carry a large balance and miss payments. There are many reasons people get into debt–with one of the main reasons being buying things you don’t need.

This is where value-based spending comes into play. Value-based spending is only spending on what you truly value. The rest is eliminated. This cuts out a very large chunk of consumer spending, which naturally reduces consumer debt.

Less consumer debt in turn means not only a healthier financial life, but also a higher credit score. So it all ties in together. Spend on what you value, cut out the unnecessary, and watch consumer debt greatly decrease.

Number 7: Create Systems to Make Sure Everything is Paid on Time

Let’s face it–we all get busy and forget things now and then. The problem with forgetting about paying bills is that it not only costs you money in fees and interest, but it also reduces your credit score. So it’s important to put systems into place to guard against human nature.

As much as you can, set up automatic monthly payments to your debts so that you don’t forget about them. That means your mortgage (or rent), debt on rental properties, utilities, etc. It’s automatically scheduled so you don’t have to worry about it.

The one exception for me is credit cards. I like to pay those manually every month so I know exactly how much I am spending. I still have a system in place though so I don’t forget–and that’s a date set aside on my calendar where I will address my credit card bill.

So it’s possible to have different systems for different bills, the key being that you have a system in place. Because it’s systems that will keep things flowing and prevent missed and late payments.

Conclusion

Having a high credit score is a good thing and certainly makes life easier in a lot of ways. But it’s not necessarily about the credit score, it’s about what you create in the process.

A near perfect credit score means that you’ve done a lot of things extremely well with your personal finances and are very likely in a great financial spot. The high credit score is nice but it’s all the other things like plenty of cash reserves, minimal to no consumer debt, low debt to income ratio, etc. that are the real wins.

Do you agree that a near perfect credit score is nice, but it’s really about the other benefits?