5 Not So Obvious Things Money Can Buy

We all know the obvious things money can buy. Food, shelter, transportation, consumer goods, among other things. But what about the less obvious? These are five not so obvious things money can buy.

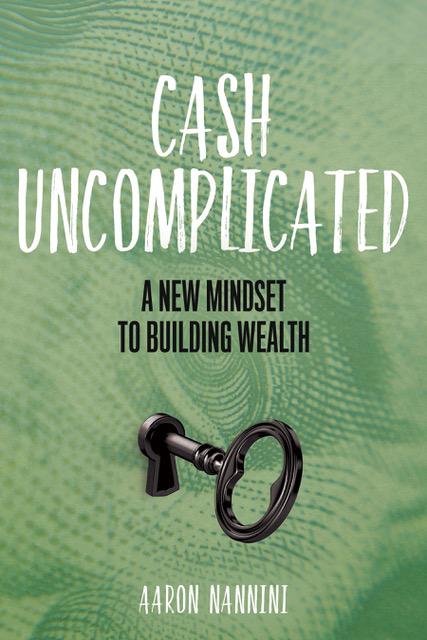

Welcome to my website! My name is Aaron Nannini and I’m the founder of Cash Uncomplicated.

Changing my mindset about personal finance has eliminated so much of the confusion and stress I used to have about money.

I believe that you can achieve complete financial harmony without sacrificing your lifestyle or happiness.

We all know the obvious things money can buy. Food, shelter, transportation, consumer goods, among other things. But what about the less obvious? These are five not so obvious things money can buy.

There’s a misnomer that the only way to be good with money is by spending less. While it’s true that many people who are financially successful are frugal, it’s not the only way. Frugality and spending less is a tool, but it’s not the only tool.

A million dollars used to be the end of the rainbow in personal finance. It literally meant that you were a “millionaire.” You had made it financially and would never have to worry about money again providing you maintained your spending habits that got you to a million in the first place. However, due to inflation, a million dollars today is not what it used to be. But it’s still a lot of money and a very worthy financial goal.

My morning routine Monday through Saturday is eerily consistent. Wake up early, eat breakfast, read a few articles, and then get to writing before the rest of the day. I’m usually done by the time my family is out of bed.

Education is everywhere. There is formal education like college and graduate school, vocational schools, personal growth books, courses, seminars, and much more. There are so many choices—it can be confusing and overwhelming. Many people end up going to college but then stop their education after that.

The average car payment for a new car in the United States is $563 per month, with the average term 70 months according to a recent article on Lendingtree.com. That’s 70 months, or almost six years of $563 car payments. For a family with two cars, multiply that number by two and you’ve got $1,126 per month!

I’m very excited to announce the release of my new book Cash Uncomplicated! On sale everywhere books are sold.

Available for Purchase Now!